Housing Platforms

Over the last years, thanks to improvements in digital technologies, sharing economy has risen to prominence reshaping several industries. Among these, hospitality is facing a deeper structural change as the newly born Airbnb has matched in few years the capacity of traditional players. Moreover, the entry of Airbnb in the hospitality market has pointed out several issues as, beyond hospitality, the short-term rental platform is a remarkable impact on the housing market and the shape of cities. Relying on a European-scale dataset, which contains granular information on the distribution of Airbnb yearly updated, the Housing Platform project is tackling some of the main consequences generated by Airbnb’s entry, thus proposing an integrated view of the entire phenomenon from various perspectives.

Year

2018-

Team

Luigi Buzzacchi, Francesca Governa, Chiara Iacovone, Francesco Milone, Emilio Paolucci, Carlo Cambini, Alessandro Destefanis, Paolo Neirotti, Elisabetta Raguseo, Laura Rondi, Lorien Sabatino

Tags

#Sharing Economy #UrbanGeography #EconomicOrganization&UrbanSpace

Type

Research project

All the analysis that support this research have been elaborated from the database provided by AirDNA, a commercial firm that collects data from the websites of two of the main OTA (online travel agency), Airbnb and HomeAway. The database acquired by FULL is yearly updated and includes all the listings within Europe from 2015 to 2019 (last version). The data are organized by three different database: Property, Monthly and Daily. The Property database include the description of any single listing and the annual performances both for Airbnb and HomeAway. While the Monthly and the Daily database collects data in a most refine granular temporality.

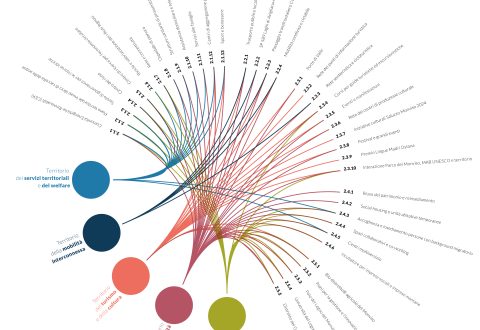

Starting from a broader scale, the first two outcomes of the project are two researches providing an overall snapshot of Airbnb both at European and Italian level. The latter research, in particular, has turned out that Airbnb is highly selective highlighting an uneven distribution of both supply and demand. Indeed, despite the platform proposes itself to be fair and equipotential (in line with the definition of sharing economy), evidences tell a different story as Airbnb’s supply is concentrated toward urban areas (more than traditional supply) and that the spatial distribution of revenues is even more concentrated (highlighting over-supply areas). Analyzing the phenomenon at a micro-level, researches participate to the flourishing debate on the relationship between the short-term rental platform and traditional hospitality. To this extent several results have emerged: higher presence of Airbnb’s supply in markets where high-end hotels own higher market shares and, under a managerial perspective, location has turned out to be the main asset in the hand of hotel-owners to moderate the threat of Airbnb. In addition to these researches, as Covid-19 has deeply changed the hospitality market, an analysis of the impact of pandemic on Airbnb has been carried out. Results have shown that the platform suffered independently to the measures of lockdown adopted (negative impacts have been found both in Milan and Stockholm) while a consistent shift in preference for apartment over shared accomodation has appeared in areas where hard measures of social distancing have been adopted. Together with these first outputs, new projects are going to start. Firstly, a new study on the impact of Airbnb on the Italian Borghi aims at assessing whether the platform can be intended as tourism-abilitator in areas where traditional supply is not present starting from the idea of utilization of idle-complementary assets in those areas. Secondly, other studies on the relationship of Airbnb and the housing market are intended to provide an overview of rents in presence of a short-term alternative, with important consequences for policy-makers. Finally, the diffusion of the platform is going to be studied, under both the innovation-diffusion theory and the entrepreneurial one.

Publications

-

Buzzacchi L., Destefanis A., Milone F. L., Paolucci E., Raguseo E., The impact of COVID-19 pandemic on sharing economy accommodation market: empirical evidence of changing preferences in main European cities, (under review – International Journal of Hospitality management)