Italy is in the Air(bnb)

The uneven diffusion of short-term rental markets between urban locations and selective tourism destinations

Over the last years, thanks to digital technologies, sharing economy has risen to prominence, reshaping several industries. Among these, hospitality has undergone a deeper structural transformation as the newly born platform Airbnb has matched traditional hospitality supply capacity in few years. The entry of Airbnb has pointed out several issues widely studied by scholars: competition and substitution with traditional hospitality, impact on the housing market, over-touristification of famous markets and touristification of new ones. This paper participates to this growing debate by studying the spatial distribution of Airbnb in Italy in 2017-18. Results show that, despite sharing economy is proposed as fair and equipotential, allowing all users with the same opportunities, Airbnb turns out to be highly selective, highlighting an uneven distribution on both supply- and demand-side. The empirical analysis provides evidence that a) the supply of Airbnb properties is especially concentrated in urban areas, more than the supply of traditional hospitality; b) the spatial concentration of revenues is much higher than the spatial density of properties, thus supporting our prediction of over-supply in areas where entry costs are lower; and c) Airbnb’s supply tend to be more intense in the submarkets where the market share of high quality hotels is higher.

Date

Test

Category

Working paper

Tags

#Airbnb #EconomicOrganization&UrbanSpace

Chapter 1

Introduction

Inside the sharing economy

The sharing economy identifies market fields in which consumers temporarily exchange idle goods through the intermediation of a digital platforms (Schor and Attwood-Charles, 2017), offering the possibility to speculate on personal assets (houses, cars, bikes, as well as time, performances or skills). It gathers a “set of initiatives sharing underutilized assets (material resources or skills) to optimize their use” (Acquier et al., 2017: 4).

When we attempt to take this general definition forwards, things become complicated. The debate around the sharing economies is highly ambiguous and fragmented due to its flexible and wide-ranging field of application. Acquier et al. refer to sharing economies as an “essentially contested concept” (2017: 2), an “umbrella construct” that offers a variety of epithets – as collaborative consumption (Botsman and Rogers, 2011), the mesh (Gansky, 2010), common-based peer-production (Benkler, 2001, cit. by Grassmuck, 2012), crowd-based capitalism (Botsman and Rogers, 2011; Sundararajan, 2016) – in a variety of disciplines, such as geography (Richardson, 2015), anthropology (Belk, 2009), sociology (Schor, 2016) and law (Pasquale, 2016). The variety of meanings and epithets related to sharing economies lead to a general “semantic confusion” (Belk, 2014), focusing on the fact that, not surprisingly, behind the sharing values, there is an economic interest. However, in scholarly economic literature, the sharing economy barely appears as an object of research and the (positive) interest is mostly focused on platform economics and multi-sided-markets (Codagnone and Martens, 2016).

This new type of economic model grew up in a variety of forms and manifestations, boasting to be close to community needs, embracing the vision of an economy sharable and sustainable. Thanks to the process of disintermediation characterizing its practices, the sharing economy presents itself as efficient, environmentally respectful, and socially just (Schor, 2016) and as the most sustainable way of exchanging goods and services. Its wide success is linked, on the one hand, to the illusion of a market where trade is organized by excluding forms of unproductive intermediation and attributing greater market power to final demand and supply; and, on the other hand, to the expectation – based on the sustainability paradigm – of making the available physical capital more productive and therefore reducing the over-production of durable consumer goods (Frenken and Schor, 2017; Benkler, 2004).

The range of examples linked to the sharing economy (or explicitly declared to be so by the promoters) sometimes belies these advantages. Sharing economy practices are often opaque, unclear and contested. As Slee pointed out, because of the overlapping of sharing value and economic value “[S]upporters sometimes describe the Sharing Economy as a new type of business and sometimes as a social movement” (2017: 9). However, sharing economies – except in fairly rare cases – determine an exchange of goods / services for money: they “are not based on ‘sharing’; rather they monetize human effort and consumers assets” (Kenney and Zysman, 2016: 62). This feature is so significant that Murillo et al. (2017) define sharing economies as “neoliberalism on steroids”.

The idea of the sharing economy emerged from the technology-oriented revolution with its “feel-good rhetoric” (Frenken and Schor, 2017: 3; Murillo et al., 2017). Digital platforms are key elements for enabling sharing mechanisms, so that sharing economy is also critically defined as “platform economy” (Srnicek, 2016). Since the object of exchange normally concerns much-differentiated goods or services, markets need to operate at a very large scale in order to achieve a reasonable level of efficiency. The crucial role of digital platforms is, then, to concentrate exchanges in a virtual marketplace. There is a complex ecology of digital platforms working in the platform economy. Some of them operate in social media and web research, such as Facebook or Google, some work as a marketplace, like Amazon, and others are more related to the “original” definition of sharing economy, as Uber or Airbnb (Kenney and Zysman, 2016).

Like the concept of sharing, the platform also has different fields of applications and different meanings. Gillespie (2010) highlights four semantic definitions of platform taken from the Oxford English Dictionary: computational, as a digitally embedded structure; architectural, as the infrastructural environment; figurative, as the concept of a tentacular and grounded status; and political, as the spreading of a vision. As an infrastructure, the innovative power of the platform lies in the indirect network effects generated by (digital) interactions between different sides of the market, thus basically opposed to a more traditional linear supply chain (Hagiu, 2007). This mechanism enables the reproduction of a marketplace, ideally open to everyone, suggesting a new economic approach based on a more flexible, autonomous and proto-entrepreneur mode of work (Martin and Zysman, 2016). However, the prevalence of competition forces seems to lead to a monopolistic drift of platforms. This has been identified both by the theoretical literature and by the empirical evidence showing the quick and homogenous concentration process in the platform industries (touristic sector, as well as mobility, real estate, delivery services, food providers, to name but a few) (Langley and Leyshon, 2016; Rogers, 2016) and, at the same time, the continuous opening of entry opportunities, due to the strong dynamic competition and the continuous innovation affecting digital platforms (Evans, 2017).

Airbnb as the champion of sharing?

The industries of individual mobility, housing and hospitality services have been deeply involved in the process of innovation (more or less disruptive; cfr. Guttentag, 2015) related to the diffusion of digital platforms (Fields and Rogers, 2019). In this sense, Uber and Airbnb might be considered paradigmatic cases, attracting special attention in the empirical researches aimed at investigating the general features of sharing economy (Cocola-Gant and Gago, 2019; Wachsmuth and Weisler, 2018; Barron et al., 2018).

Both Uber and Airbnb entered the traditional markets of services (Uber in the market of vehicles for hire with a driver; Airbnb in the market of short-term rental of rooms or apartments) actually offering a limited product differentiation with respect to the incumbents. However, they introduced new models for connecting demand and supply and for supporting new entrepreneurial ventures within the framework of the gig economy (Friedman, 2014; Burtch et al., 2019). They both provide an alternative offer to the already existing one (Artioli, 2018), highlighting a demand not entirely satisfied by the traditional supply (Davidson and Infranca, 2016).

In particular, Airbnb, the leading platform of short-term rentals, acts as an intermediary for host and guest who wants to rent accommodation for a short period of time. First launched in 2008 in the U.S. it is now present in 81 thousand cities with around 4.5 million listings and around $41 billion dollars earned by hosts (Deboosere et al., 2019). Its basic philosophy of yielding a return on an idle asset such as a second home or an extra room perfectly matches the above-mentioned sharing rhetoric, while its continued expansion can be interpreted as the network generated by platform capitalism. According to Roelofsen and Minca (2018), Airbnb uses the rhetoric of local community and belonging to “juxtapose itself to the standardized services of ‘modern tourism’, somehow adhering to the age-old critique of the commodification of cultures and tourism experiences (see MacCannell, 2013 [1989]). The platform claims to be alternative to mass-produced and impersonal travel experiences, by offering the possibility of sleeping and living in the spaces where ‘real life’ supposedly takes place and experience what it means to ‘live like a local’” (Roelofsen and Minca, 2018: 174).

The rapid spread of Airbnb globally has given rise to numerous studies investigating the nature of the phenomenon from an economic, spatial and political point of view, mostly focusing on single case studies (Cocola-Gant and Gago, 2016; Yrigoy, 2016; Freytag and Bauder, 2018; Semi and Tonetta, 2020) while fewer showing the multiple geographies of Airbnb at national or macro-regional level (Adamiak, 2018, 2019; Crommelin et al., 2018; Jiao and Bai, 2019)1.

A number of studies investigate the effects of Airbnb both on the traditional tourism hospitality system and on the performance of the real estate market, showing the role of Airbnb in redefining the relationships between residential and tourist housing. Indeed, so far, international tourism was going on a flourishing period, mostly due to the ease and affordability of travelling – from the spread of low-cost airline companies to the opening of new routes. Some scholars identified a negative impact of Airbnb on the hotel industries in terms of occupancy rates and pricing (Zervas et al., 2017; Mhlanga, 2019), while others highlighted the positive effect of Airbnb on the hospitality and tourism industry as a whole, bringing about an increase in employment in the hotel sector (Dogru et al., 2020) and relaxing capacity constraints on hotels in the short term (Farronato and Fradkin, 2018). Finally, other scholars showed a sort of neutral effect of Airbnb on traditionally hospitality industries due to the different services and facilities offered and therefore the different users that choose between Airbnb and hotels (Goree, 2016).

Inserted within the phenomena of over-tourism (Goodwin, 2017), mainly in urban areas, the platform, both scattering and concentrating tourist accommodations, triggers a mechanism that induces or accelerates economic touristic-oriented dynamics, increasing the tourist facilities and provoking a modification of the commercial and social pattern. These dynamics seem to lead to gentrification processes, social displacement or patterns of spatial inequalities (Wachsmuth and Weisler, 2018; Allegri and Serpa, 2016; Balampanidis et al., 2019; Cocola-Gant and Gago, 2019). Accordingly, housing and rental market are equally affected by dynamics triggered by the platform: the large numbers of houses listed on the platform can increase the average price in the rental market (Wachsmuth and Weisler 2018; Barron et al., 2018) due to the fact that part of the accommodation capacity could be removed from the traditional rental market because of the higher profitability and flexibility of Airbnb (Cocola-Gant and Gago, 2019).

Finally, how to regulate the urban impacts of the platform’s spread is (or was?) a rising issue. While Ferreri and Sanyal claim that the “multiple geographically specific manifestations [of Airbnb]” (2018: 6) prevent a common regulation, the measures adopted by local authorities are mainly devoted to limit the speculative behavior of the hosts and/or fight tax evasion. For example, most of the large European cities limit the maximum number of nights that the listing can remain online, from 120 days a year in Paris, 30 in Amsterdam, to Berlin which, from 2016 to 2018, completely banned the use of Airbnb, now has a limit of 90 days a year. Others, such as Lisbon or Barcelona stipulate that a licence must be requested, in San Francisco the issue of the license costs 250 USD. Paris, Berlin and Amsterdam restrict the usage of the platform only to the main residence. A few, such as Athens and Amsterdam, regulate the accommodation’s features (fire safety standards and sanitary conditions). To control the fluxes for fiscal reasons, Italy has adopted a flat tax withheld by Airbnb, while Athens and Copenhagen use a progressive method based on the annual revenues.

Notes

-

1. Geographies of Airbnb at national or macro-regional level

This gap could be attributed to the difficulty in retrieving data. Airbnb does not share its performance data. They can be obtained either through commercial firms, such as AirDNA or Transparent or by scraping them with codes that activists have created online (for example, Tom Slee, or Murray Cox with its Inside Airbnb). In both cases, the availability of data is limited by the requirement for significant effort, both economic and of skill.

-

2.

While the paper was in process, the pandemic of Sars-CoV2 occurred. Our findings and statements are based on the pre-pandemic condition.

To achieve this objective, the work has made use of a dataset that offers wide empirical evidence on the demand and supply of short-term hospitality through the Airbnb platform in Italy. When markets are in equilibrium, demand and offer are expected to balance each other, and the analysis can focus on just one side. The way demand and supply unfold in this specific market, however, deserves special attention.

On the demand side, the request for short term hospitality is determined by the mobility of individuals, mainly explained by touristic, professional and education preferences. Thus, demand is not uniformly distributed throughout the country. On the other hand, two economic traits identify the offer side of the Airbnb platform:

- hospitality services are greatly differentiated, mainly, although not only, in terms of location (i.e. different listings are normally imperfect substitutes);

- entry is not hindered by severe entry barriers in terms of human capital, but needs the availability of a physical asset (the property), whose opportunity-cost is defined by the conditions set by the residential rental market.

If low entry barriers and the solution of every geographic constraint for accessing a platform could anticipate a spatial distribution of the supply fairly correlated with the spatial profile of the demand, a significant mismatch between demand and supply is expected. This could happen because a) entry processes in the Airbnb market are still in the early stages of expansion of the life cycle; and b) low entry costs and the widespread estate ownership in Italy can easily lead to an over-supply of local properties.

Questioning the issue of the accessibility and selectivity of the platform economy, the paper critically discusses two main points. The first one is related to the pattern drawn by the geographical distribution of the listing, and in particular, whether the diffusion process shows a peculiarly urban nature. The second one is the issue of accessibility and competition in the whole market. Despite its rapid growth, the supply of Airbnb listings shows significant gaps, both with respect to the actual demand for Airbnb services and with respect to the demand of short-term hospitality.

The paper is organized as follows. After this introduction, par. 2 illustrates the available data and some methodological choices introduced for investigating Airbnb distribution (in terms of properties, occupation and revenues) at the national scale. Par. 3 outlines the general figures of Airbnb in Italy, while par. 4 discusses Airbnb as an urban phenomenon and as a touristic device. Finally, the conclusions underline the main results of our analysis, and in particular illustrate the urban features of Airbnb, the (im)balance between the demand and supply, and its uneven distribution in its non-urban spread. Some more paths to be followed in this field of inquiry are also proposed.

Chapter 2

Airbnb in Italy: data and methodology

The analyses conducted are first supported by a dataset we have built covering a complete set of information on Airbnb presence and activity in Italy. The data have been extracted from the datasets furnished by AirDNA, a provider of short-term vacation rental data and analytics. This data scraping commercial firm extracts information from Airbnb’s official webpages and its datasets are widely used among scholars to perform analyses upon this topic.

Our dataset considers each property located in Italy that was listed for at least one day from January, 1st 2017 to December 31st 2018. For each property (divided into “apartment”, “single room” and “shared room” categories) data include location, listing story (entry, reserved days, blocked days and possibly exit), and each daily price3. From this original information, we have obtained stock and flows of properties, revenues, occupancy rates and average daily prices at a municipal level. Municipal measures were later aggregated at different scales. In addition to the AirDNA datasets, we have used extensively ISTAT (Italian National Institute of Statistics) data that provide a wide range of variables on different geographic scales. In particular, our dataset includes, at a municipal level i) several demographic variables and ii) measures concerning the organization of the traditional hospitality industry (in particular the number of hotels and beds, segmented by their rating – number of stars). Additional morphological and economic information has been collected at a Local Labour Market Areas (LLMA) scale4.

-

3.

Airbnb (and consequently AirDNA) random obfuscates the geo coordinates of each single property. Listings are not exactly located on latitude and longitude provided by AirDNA, but in a random point within a 200m radius from the provided location (Doboosere et al., 2019). Obfuscation, however, does not affect our results since our analysis will be at a municipal or higher scale.

-

4.

The Local Labor Market Areas represent a geographical subdivision beyond the administrative borders, based on the commuting flows, i.e. they are economically integrated spatial units. The concept includes a harmonised methodology and standardised definition, which should be usable and replicable in the whole EU (https://ec.europa.eu/eurostat/cros/content/labour-market-areas_en). The definition of LLMA in Italy is updated in accord with every general Census by ISTAT (Istituto Nazionale di Statistica). The last Census is dated 2011.

Chapter 3

Figures and current scale of Airbnb in Italy

The importance of the Airbnb market at European level is documented in Table 1. In 2018, Italy was the second European country after France for number of listed properties. Under almost every other indicator, Italy is also in either second or third place. There are two significant exceptions: in 2018, the Italian occupancy rate was 22.9% (in fourth lowest place amongst the listed countries) and the average revenue per night in 2018 was US$122.1 (in fifth place). These two data characterise the Airbnb supply on the Italian market. In particular, the large number of listed properties and an average low rate of occupancy of the properties (expressed as the ratio between reserved days and listed days) appear consistent with respect to the limited barriers to entry into the Airbnb market. In other words, the Airbnb market in Italy displays selective profitability with a significant over-supply in specific areas. The relatively low average daily revenue compared to other European countries would appear, at least in part, to be explained by the low rate of occupancy caused by the strong pressure on the supply side.

Tab 1

| Country | Active properties (000) 1,2 | Revenues (a) (US$ millions) |

Reservations (millions) |

Reserved days (b) (millions) |

Active hosts (000)<sub>3</sub> | Occupancy rate<sub>4</sub> | AVG revenue (a/b) (US$) |

| France | 905.5 | 5,283 | 11.8 | 44.8 | 607.8 | 29.3% | 118.0 |

| Italy | 615.1 | 3,804 | 8.9 | 31.2 | 310.1 | 22.9% | 122.1 |

| Spain | 522.2 | 3,635 | 7.3 | 28.4 | 250.3 | 27.8% | 127.8 |

| United Kingdom | 440.4 | 3,609 | 8.0 | 25.8 | 244.7 | 36.2% | 140.1 |

| Germany | 298.8 | 1,263 | 4.0 | 15.0 | 201.0 | 32.7% | 84.5 |

| Russia | 178.9 | 293 | 1.4 | 4.6 | 105.3 | 13.7% | 64.2 |

| Croatia | 138.1 | 754 | 1.7 | 6.5 | 41.9 | 22.7% | 115.1 |

| Greece | 134.3 | 836 | 1.6 | 6.1 | 69.6 | 22.1% | 137.7 |

| Portugal | 109.3 | 829 | 2.2 | 8.1 | 50.5 | 34.5% | 102.9 |

| Netherlands | 95.8 | 759 | 1.5 | 5.4 | 67.5 | 43.7% | 140.6 |

| Denmark | 88.7 | 458 | 1.0 | 4.2 | 64.3 | 35.2% | 110.1 |

| Poland | 59.5 | 233 | 1.3 | 3.6 | 29.0 | 33.4% | 64.1 |

An in-depth look at the Italian situation highlighting the size of the Airbnb phenomenon, both in absolute and in relative terms, is shown in tables 2 and 3. In 2018, more than 615 thousand properties were offered on Airbnb, corresponding to just under 2.65 million beds. Still in the same year, the revenue amounted to around 3.1 billion Euro, with an increase of 35.8% compared to 2017. During the 2017-2018 period, there were just over 32 thousand hotels in Italy, corresponding to just over 2.2 million beds (source ISTAT, Capacità degli esercizi ricettivi). In 2016, the turnover of accommodation services activity in Italy was around 23.6 billion Euro (Federalberghi, 2019). As another comparison indicator, Table 3 shows that, in 2018, slightly more than 31 million days were booked in Airbnb properties in Italy, whilst the overall number of beds reserved, relative to the tourist influx in Italy of EU residents, was around 368 million days per person5.

In 2018, the average length of stay at the properties listed on Airbnb was 3.48 days (see again Table 3), slightly down compared to 2017 (3.55). By way of comparison, the average stay in hotel accommodation in Italy during the same period was slightly lower (3.39 in 2017 and 3.32 in 2018), which suggests a similar trend in demand to Airbnb, at least from this point of view6.

The scale of the supply of temporary accommodation using Airbnb is comparable to that of traditional hotel accommodation supply in terms of number of beds, although its capacity to generate income is significantly lower (because of lower bed occupancy levels in the properties, lower occupancy of the properties and a less stable supply over time). A further element characterising the supply of Airbnb in Italy is the negligible role of shared rooms and the limited and diminishing importance of private rooms, both in terms of the number of properties and the income generated. In 2018, apartments made up 75.1% of the total properties, with 87.6% of the revenue; private rooms 24.1%, with 12.3% of the revenue and shared rooms 0.8% with only 0.1% of the revenue. Overall, the total income generated by rooms (private and shared) decreased from 14.1% in 2017 to 12.4% in 2018.

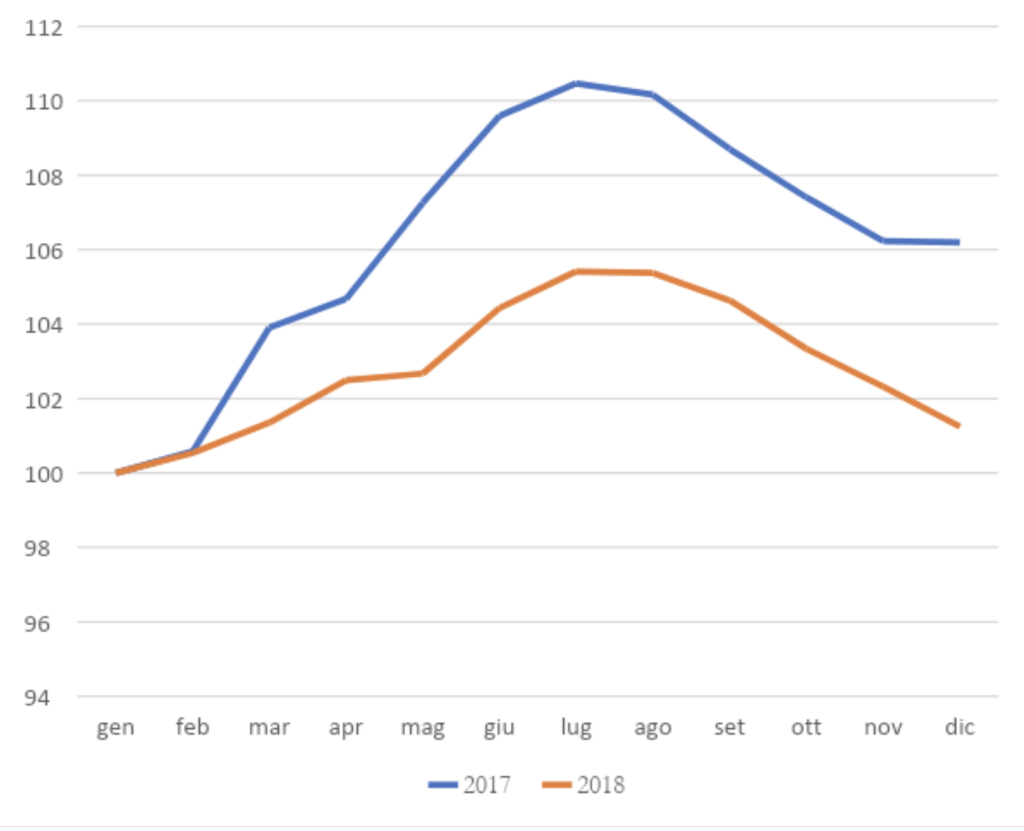

The growth in provision and income is, however, significant. The number of listed properties in Italy at the end of the month between January 2017 and December 2018 shows a monthly rate of increase of 1.68% (2.05% in 2017 and 1.25% in 2018). This growth is sufficiently high to hide the seasonality of the phenomenon which instead is revealed by Fig. 1, where the number of properties listed at the end of the month are normalized and deseasonalized; there is a clear greater average supply in the summer months, even if the different destinations and objectives of the demand for hospitality display fairly varied patterns, which could only be analysed at a less aggregated level.

-

5.

As for the purpose of the trip, 9.7% of the reserved nights were for professional purposes, 60.3% for holidays, leisure and recreation and 30.0% for other personal purposes. The source of these data is the ‘annual data on trips of EU residents’ statistics (ec.europa.eu/eurostat/web/tourism/data/database).

-

6.

Using this indicator, further analysis can be obtained by distinguishing between hotels in the top-class category (4 and 5 stars), hotels in a lower category (1, 2 and 3 stars) and tourist residences. In all three subdivisions, there was a slight reduction in length of stay between 2017 and 2018, just as there was for Airbnb. So, the average length of stay in hotels in the top category in 2018 was 2.58 days, in hotels in a lower category 3.14 days and, in tourist residences, 5.39 days.

Fig. 1 – Trend-adjusted monthly number of listed properties in Italy (January index = 100)

In any case, from the figures reported in Table 2, a notable turnover is highlighted amongst the properties: those listed at least one day in every year of reference are between 23% and 24% more than their number averagely listed at the end of each individual month. There are comparable figures for beds, instead of for the properties.

Finally, Tab. 4 illustrates how the performances of the supply of accommodation have systematically shown a net improvement: the revenues per property and the revenues per day available increased by 11.7% and 22% respectively between 2017 and 2018 against a slight contraction in the average number of days available per property. This increase can be attributed more to the net increase in the occupancy rate – going from 19.6% to 22.9% – than to the earnings per day booked which only increased by 0.2%. The moderate growth in the average price derives mainly from the reconfiguration of the distribution between apartments (which show a higher average price) and rooms, while there is a reduction in the average price of all types of property.

Tab. 2

| 20171 | 20181 | 31/12/17 2 | 31/12/18 2 | |||

| Listed properties (000) | 506.0 | 615.1 | +21.6% | 447.7 | 528.3 | +18.0% |

| Listed apartments (000) | 375.2 | 461.8 | +23.1% | 334.8 | 400.1 | +19.5% |

| % | 74.2 | 75.1 | 74.8 | 75.7 | ||

| Listed private rooms (000) | 126.3 | 148.4 | +17.5% | 109.5 | 124.8 | +14.0% |

| % | 25.0 | 24.1 | 24.5 | 23.6 | ||

| Listed shared rooms (000) | 4.2 | 4.7 | +10.6% | 3.2 | 3.5 | +10.2% |

| % | 0.8 | 0.8 | 0.7 | 0.7 | ||

| Average (monthly) listed properties (000) | 409.2 | 498.8 | +21.9% | |||

| Rotation index (a/b) | 1.24 | 1.23 | ||||

| (c) Listed beds (000) | 2,162.2 | 2,643.6 | +22.9% | 1,926.6 | 2,282.6 | +18.5% |

| Listed apartments (000) | 1,802.2 | 2,215.6 | +22.9% | 1,612.7 | 1,921.7 | +19.2% |

| % | 83.3 | 83.8 | 83.7 | 84.2 | ||

| Listed private rooms (000) | 348.7 | 415.6 | +19.2% | 305.1 | 351.3 | +15.1% |

| % | 16.1 | 15.7 | 15.8 | 15.4 | ||

| Listed shared rooms (000) | 11.4 | 12.5 | +9.7% | 8.8 | 9.5 | +8.5% |

| % | 0.5 | 0.5 | 0.5 | 0.4 | ||

| (d) Average (monthly) listed beds (000) | 1,754.5 | 2,153.3 | +22.7% | |||

| Rotation index (c/d) | 1.23 | 1.23 |

Tab. 3

| 2017 | 2018 | ||

| (e) Revenues (millions €) | 2,266.2 | 3,077.2 | +35.8% |

| Listed apartments (millions €) | 1,948.3 | 2,695.9 | +38.4% |

| % | 86.0 | 87.6 | |

| Listed private rooms (millions €) | 314.4 | 377.7 | +20.1% |

| % | 13.9 | 12.3 | |

| Listed shared rooms (millions €) | 3.3 | 3.6 | +6.8% |

| % | 0.1 | 0.1 | |

| (f) Available days (millions) | 94,0 | 104,8 | +11.3% |

| Listed apartments (millions) | 68,3 | 77,0 | +12.7% |

| % | 72.6 | 73.5 | |

| Listed private rooms (millions) | 25,0 | 27,1 | +8.2% |

| % | 26.6 | 25.8 | |

| Listed shared rooms (millions) | 0.7 | 0.7 | -5.6% |

| % | 0.5 | 0.4 | |

| (g) Reserved days (millions) | 23,0 | 31,2 | +35.5% |

| Listed apartments (millions) | 17,8 | 24,8 | +39.0% |

| % | 77.6 | 79.6 | |

| Listed private rooms (millions) | 5,1 | 6,2 | +23.5% |

| % | 23.5 | 22.0 | |

| Listed shared rooms (millions) | 112 | 130 | +15.6% |

| % | 0.5 | 0.4 | |

| (h) Reservations (000) | 6,480.5 | 8,948.7 | +38.1% |

| Listed apartments (000) | 4,609.8 | 6,619.8 | +43.6% |

| % | 71.1 | 74.0 | |

| Listed private rooms (000) | 1,829.3 | 2,280.1 | +24.6% |

| % | 28.2 | 25.5 | |

| Listed shared rooms (000) | 41.3 | 48.7 | +16.2% |

| % | 0.6 | 0.5 | |

| Average length of stay (g/h) | 3.55 | 3.48 | -1.9% |

Tab. 4

| 2017 | 2018 | ||

| Revenues per listed property (000 €) (e/a) | 4.48 | 5.00 | +11.7% |

| Listed apartments (000) | 5.19 | 5.84 | +12.4% |

| Listed private rooms (000) | 2.49 | 2.55 | +2.2% |

| Listed shared rooms (000) | 0.79 | 0.76 | -3.5% |

| Available days per listed property (f/a) | 186.0 | 170.3 | -8.4% |

| Listed apartments | 182.0 | 166.7 | -8.4% |

| Listed private rooms | 198.1 | 182.4 | -7.9% |

| Listed shared rooms | 173.3 | 148.0 | -14.6% |

| Occupancy rate (g/f) | 0.196 | 0.229 | +16.7% |

| Listed apartments | 0.207 | 0.244 | +17.6% |

| Listed private rooms | 0.168 | 0.187 | +11.5% |

| Listed shared room | 0.133 | 0.158 | +18.9% |

| Revenues per available day (€) (e/f) | 24.1 | 29.4 | +22.0% |

| Listed apartments | 28.5 | 35.0 | +22.7% |

| Listed private rooms | 12.6 | 14.0 | +11.0% |

| Listed shared rooms | 4.6 | 5.2 | +13.1% |

| Revenues per reserved day (€) (e/g) | 98.5 | 98.8 | +0.2% |

| Listed apartments | 109.2 | 108.8 | -0.4% |

| Listed private rooms | 62.3 | 60.6 | -2.7% |

| Listed shared rooms | 29.7 | 26.9 | -7.6% |

The overall picture of Airbnb at a national level demonstrates clear trends in diffusion and performance. It is interesting therefore to assess to what degree these phenomena occur in a uniform manner throughout Italy and to what degree the variations are regional.

In a nutshell, the question we need to ask is whether innovative platforms and technologies are characteristic of social strata and “elected” regions and, therefore, if they have distinctive profiles of concentration, or whether the “democratic” accessibility of digital technology promotes broad, non-polarized diffusion of the new forms of hospitality. In order to ascertain the distribution and concentration of Airbnb, we will operate essentially on three spatial levels: macro-areas (NUTS1), local labour market areas (LLMA) and municipalities.

We shall look, firstly, at the regional distribution of Airbnb in the macro-areas – North-West, North-East, Centre, South and Islands – into which Italy is traditionally subdivided for both statistical and political/electoral purposes (specifically, constituencies for the European elections). Table 5 shows that population, traditional hospitality and Airbnb (both from the point of view of supply and demand) are distributed in a radically different way: traditional hospitality seems to be significantly more pronounced in the North-East; Airbnb in the Centre and the Islands.

Tab. 5

| AIRBNB | HOTELS | |||||||||||

| Population (millions) | Properties | Beds (000) | Revenues (millions €) | Hotels | Beds (000) | |||||||

| NORTH-WEST | 16,1 | 26,6% | 124.815 | 20,3% | 479,6 | 18,1% | 592,2 | 19,2% | 5.948 | 18,5% | 358,5 | 16,2% |

| NORTH-EAST | 11,6 | 19,2% | 73.505 | 12,0% | 292,9 | 11,1% | 430,3 | 14,0% | 13.280 | 41,3% | 783,9 | 35,4% |

| CENTRE | 12,1 | 19,9% | 180.144 | 29,3% | 800,4 | 30,3% | 1.170,0 | 38,0% | 6.281 | 19,5% | 448,6 | 20,3% |

| SOUTH | 14,0 | 23,2% | 116.653 | 19,0% | 528,2 | 20,0% | 457,0 | 14,9% | 4.679 | 14,5% | 416,3 | 18,8% |

| ISLANDS | 6,7 | 11,0% | 119.965 | 19,5% | 542,5 | 20,5% | 427,8 | 13,9% | 2.001 | 6,2% | 206,2 | 9,3% |

| ITALY | 60,5 | 100,0% | 615.082 | 100,0% | 2.643,6 | 100,0% | 3.077,2 | 100,0% | 32.189 | 100,0% | 2.213,5 | 100,0% |

This evidence is however of little use in interpreting the phenomenon: all the macro-areas are very heterogeneous encompassing urban, tourist and rural areas. Furthermore, it is not clear if, and to what degree, the Airbnb phenomenon is concentrated, or better, “more” concentrated in respect of the “natural” benchmarks: population and traditional hospitality.

Table 6 shows the concentration of demand and supply of Airbnb as compared with the two benchmarks indicated above at LLMA scale. In particular, it reports the share of population, surface areas of the region, supply of traditional hospitality, demand and supply of Airbnb in the larger (for that variable) k LLMAs. For example, the LLMA with the largest share of Airbnb properties is Rome which accounts for 8.3% of the total; the two LLMAs in the study with the largest share of Airbnb properties are Rome and Milan, accounting for 14.7% of the total properties and so on; vice versa, the LLMA which contains the largest share of hotels is again Rome with 4.7% of the total hotels; the two LLMAs which contain the largest share of hotels are Rome and Rimini, making up 8.1% of the total hotels and so on.

Tab. 6

| ITALY | HOTEL | AIRBNB | |||||

| k | Cum. LLMA population | Cum. LLMA properties | Cum. LLMA beds | Cum. LLMA properties | Cum. LLMA beds | Cum. LLMA reserved days | Cum. LLMA revenues |

| 1 | 6,3% | 4,7% | 6,1% | 8,3% | 7,3% | 13,5% | 12,8% |

| 2 | 12,6% | 8,1% | 9,7% | 14,7% | 11,7% | 19,6% | 18,9% |

| 3 | 16,8% | 10,6% | 12,9% | 18,4% | 15,1% | 25,6% | 23,9% |

| 5 | 21,2% | 15,2% | 17,1% | 22,9% | 19,1% | 32,7% | 31,0% |

| 10 | 27,6% | 23,1% | 25,0% | 29,8% | 25,4% | 40,3% | 38,6% |

| 20 | 36,6% | 34,1% | 34,7% | 39,3% | 35,1% | 49,7% | 48,3% |

| 50 | 50,2% | 49,8% | 50,8% | 55,5% | 52,9% | 64,4% | 65,3% |

| 100 | 63,4% | 65,7% | 68,0% | 70,6% | 68,8% | 78,2% | 80,1% |

These data show that a) the supply of Airbnb properties is more concentrated than population and much more than hotels; and b) Airbnb demand (reserved days and revenues) is more concentrated with respect to the supply.

This evidence is understandable, but not entirely obvious: the destinations of those travelling for economic or holiday purposes are not necessarily those places where there is the greatest concentration of population. In fact, the supply of traditional hospitality is less concentrated with respect to the population distribution. On the other hand, the supply of Airbnb is more concentrated with respect to the population distribution. The picture which emerges of the distribution of Airbnb is therefore of a greater concentration of properties in the more populous areas of the country.

The fact that the demand for hospitality via the Airbnb platform is even greater than the supply should not be surprising: as has already been widely discussed, the low barriers to entry of the “new” hospitality brings about a less selective supply than demand. We therefore expect to see areas of the country in which there is an over-supply.

The information gathered so far is evidence of the accumulation of demand/supply of innovative hospitality, but it tells us little about the characteristics of the places where this concentration is manifested. In the following section, we discuss the hypothesis that the places where Airbnb is concentrated are, on the one hand, urban and, on the other, regions with specific characteristics of the demand7.

-

7.

Without entering into the merits of the difficult, if not impossible, delimitation of the urban, we will define “urban LLMA” those where the central municipality has a population of at least 200,000 inhabitants. The low demographic threshold of what we consider to be a “city” is directly related to the very moderate size of Italian urban centres, even in comparison with urban centres in other parts of Europe (Dematteis, 1999).

Chapter 4

The uneven distribution of short-term rentals

Airbnb as an urban phenomenon

The sharing economy and digital platforms are often considered to be an urban phenomenon, benefiting both from the density of population, the spatial proximity and the socio-economic specialisation of the urban agglomerations (Rauch and Scheicher, 2005; Davidson and Infranca, 2016; Artioli, 2018). With specific reference to the advantages of agglomeration, reinterpreted by Duranton and Puga (2004) as mechanisms of sharing, matching and learning, Davidson and Infranca (2016) claim that the urban character of the sharing economy refers both to the localisation of practices and to the role of the platforms as agents of urban transformation. In turn, Langley and Leyshon (2017) consider the platforms to be socio-technical agents of intermediation that actively provoke, produce and programme the circulation, in Airbnb’s case of tourist flowsIn this perspective, it is not just a case of considering the advantages that the city offers to the localisation of activities of the sharing economy and, specifically, of the Airbnb properties, but of taking into consideration, on the one hand, what the impact is of Airbnb on the urban fabric (in particular, on the rentals market or on the characteristics of retail sales) and, on the other, the agency of the city, which in turn is viewed as a “machinic infrastructure” (Amin and Thrift, 2017), in influencing the performance (and therefore the revenues) of Airbnb8.

The urban localisation of Airbnb properties is shown in Table 7, that compares the regional distribution of Airbnb properties and hotels, subdivided between central municipalities of the LLMAs and other municipalities. In addition, LLMAs are also distinguished in “urban”, that is those 16 LLMAs centred around the most populous Italian municipalities, and “non-urban”. The attraction for the flows of travellers in the different municipalities classified in the table is very different: the big cities attract economic and tourist movement; the settlements in the metropolitan belts have a fairly limited attraction; the 595 “non-urban” LLMAs have reasonably heterogeneous characteristics, from the small cities of art to the tourist destinations and the places which are not associated with a significant demand for hospitality. Table 7 shows a clear concentration of Airbnb in the big cities (27.0% of the properties, with 16.2% of the population and almost double the bed capacity compared to that offered by the hotels, 582 thousand beds against 314 thousand), whilst the distribution of Airbnb and hotels outside of the big cities does not display significant differences in absolute terms.

Tab. 7

| AIRBNB | HOTELS | |||||||||||

| Population

(millions) |

Properties | Beds (000) | Revenues (millions €) | Hotels | Beds (000) | |||||||

| ‘Urban’ LLMA1 | 19.3 | 31.9% | 194,073 | 31.6% | 696.8 | 26.4% | 1,132.1 | 36.8% | 4,912 | 21.2% | 441.6 | 20.0% |

| Centre municipality | 10.1 | 16.7% | 166,169 | 27.0% | 582.0 | 22.0% | 1,031.9 | 33.5% | 3,429 | 16.6% | 314.4 | 14.2% |

| Other municipalities | 9.2 | 15.2% | 27,904 | 4.5% | 114.8 | 4.3% | 100.2 | 3.3% | 1,483 | 4.6% | 127.2 | 5.7% |

| ‘Non-urban’LLMA1 | 41.2 | 68.1% | 421,009 | 68.4% | 1,946.7 | 73.6% | 1,945.1 | 63.2% | 27,278 | 78.8% | 1,771.8 | 80.0% |

| Centre municipality | 16.9 | 27.9% | 187,995 | 30.6% | 825.7 | 31.2% | 842.1 | 27.4% | 16,690 | 45.9% | 804.0 | 36.3% |

| Other municipalities | 24.3 | 40.2% | 233,014 | 37.9% | 1,121.0 | 42.4% | 1,103.0 | 35.8% | 10,588 | 32.9% | 967.8 | 43.7% |

| ITALIA | 59.4 | 100.0% | 615,082 | 100.0% | 2,643.6 | 100.0% | 3,077.2 | 100.0% | 32,189 | 100.0% | 2,213.5 | 100.0% |

Tab. 8

| LLMA population (000) | CM population (000) | LLMA Airbnb beds | CM Airbnb beds | LLMA hotel beds | LLMA hotel beds | LLMA revenues (millions €) | CM revenues (millions €) | CM occupancy rate | OM occupancy rate | CM revenues per reserved day | OM revenues per reserved day | |||||

| ROME | 3,806.7 | 2,872.8 | 75.5% | 191,815 | 172,948 | 90.2% | 135,037 | 119,516 | 88.5% | 394.2 | 382.9 | 97.2% | 38.9% | 14.2% | 94.0 | 77.1 |

| MILANO | 3,908.2 | 1,366.2 | 35.0% | 116,997 | 101,897 | 87.1% | 79,917 | 50,294 | 62.9% | 151.8 | 141.6 | 93.3% | 30.6% | 21.0% | 82.7 | 54.7 |

| NAPLES | 2,555.1 | 966.1 | 37.8% | 51,892 | 45,222 | 87.1% | 19,901 | 12,385 | 62.2% | 55.3 | 51.1 | 92.4% | 30.3% | 17.2% | 61.6 | 60.5 |

| TORINO | 1,757.2 | 882.5 | 50.2% | 28,548 | 24,636 | 86.3% | 21,464 | 13,299 | 62.0% | 23.8 | 22.0 | 92.4% | 30.3% | 13.9% | 51.6 | 53.1 |

| PALERMO | 900.7 | 668.4 | 74.2% | 41,832 | 33,700 | 80.6% | 13,768 | 8,189 | 59.5% | 28.3 | 24.4 | 86.1% | 21.9% | 10.5% | 54.0 | 88.3 |

| GENOA | 672.3 | 580.1 | 86.3% | 14,367 | 12,065 | 84.0% | 8,944 | 7,443 | 83.2% | 14.9 | 12.8 | 85.6% | 31.3% | 21.6% | 61.1 | 87.2 |

| BOLOGNA | 880.1 | 389.3 | 44.2% | 25,120 | 21,102 | 84.0% | 20,959 | 12,163 | 58.0% | 38.1 | 35.2 | 92.5% | 39.7% | 18.2% | 70.9 | 64.9 |

| FLORENCE | 721.1 | 380.9 | 52.8% | 89,341 | 68,183 | 76.3% | 39,025 | 32,470 | 83.2% | 186.0 | 147.6 | 79.4% | 42.8% | 26.8% | 92.6 | 146.9 |

| BARI | 746.9 | 323.4 | 43.3% | 10,446 | 6,290 | 60.2% | 6,852 | 5,029 | 73.4% | 9.4 | 7.3 | 77.2% | 32.0% | 12.2% | 56.6 | 68.2 |

| CATANIA | 709.3 | 311.6 | 43.9% | 29,868 | 15,447 | 51.7% | 9,714 | 4,412 | 45.4% | 21.8 | 12.5 | 57.0% | 24.9% | 13.9% | 49.8 | 88.5 |

| VENICE | 611.5 | 261.3 | 42.7% | 53,977 | 48,911 | 90.6% | 40,456 | 31,556 | 78.0% | 156.5 | 151.1 | 96.6% | 41.5% | 27.5% | 122.0 | 68.2 |

| VERONA | 470.1 | 257.3 | 54.7% | 18,977 | 15,471 | 81.5% | 11,162 | 6,252 | 56.0% | 31.5 | 27.8 | 88.2% | 34.4% | 19.1% | 88.2 | 91.0 |

| MESSINA | 256.9 | 234.3 | 91.2% | 3,657 | 3,221 | 88.1% | 1,600 | 1,350 | 84.4% | 1.3 | 1.2 | 92.8% | 11.7% | 7.3% | 59.2 | 63.4 |

| PADUA | 682.2 | 210.4 | 30.8% | 7,991 | 4,845 | 60.6% | 25,870 | 5,503 | 21.3% | 8.3 | 5.6 | 67.8% | 34.0% | 21.8% | 55.6 | 75.7 |

| TRIESTE | 234.6 | 204.3 | 87.1% | 6,341 | 5,585 | 88.1% | 4,342 | 3,116 | 71.8% | 8.7 | 7.9 | 91.2% | 34.1% | 23.2% | 68.0 | 81.3 |

| TARANTO | 383.1 | 198.3 | 51.8% | 5,655 | 2,519 | 44.5% | 2,662 | 1,470 | 55.2% | 2.2 | 1.0 | 43.7% | 14.5% | 9.2% | 47.6 | 89.1 |

When looking at this evidence, it is then legitimate to ask whether the diffusion of Airbnb in the urban areas of the country is relatively uniform and, if not, what distinguishes them.

Table 7 shows, firstly – as already mentioned on several occasions – that the Airbnb revenues are more concentrated than Airbnb properties: 33.5% of Airbnb income comes from the 16 biggest Italian cities, which have 27.0% of the properties and 22.0% of the beds.

In relation to this, Table 8 directly examines the number of Airbnb in 2018 in the 16 most populous Italian municipalities and the LLMAs in which they are located. The points that emerge are that a) apart from two exceptions (Catania and Taranto, which have popular tourist development in the surrounding areas, independently of that in the city), in each urban LLMA, more than 60% of Airbnb beds are located in the centre, frequently rising to 85-90%; b) the revenues vary greatly throughout the big cities: from 1.3 million Euro in Messina to 394.2 million Euro in Rome; c) the variance of the revenues per day, is attributable mainly to the variance of the occupancy rate, rather than to the variance of prices9.

This last point is further confirmation of the heterogeneous gaps between demand and supply in the Airbnb market: the costs of entry into the Airbnb sector are very low and the marginal costs likewise. It should also be taken into consideration that these costs, as well as being low, are to a large degree “in kind” (time and availability of properties), and therefore the opportunity-cost among the different “entrepreneurs” is highly variable. In other words, it is no surprise that many of the Airbnb properties are fairly unprofitable: the incentive to make a property available on the platform is, in general, high, even if the expected demand is low10.

What has been observed is that all the centres of the urban LLMAs, with the exception of Taranto (44.5%), which is moreover the least populous of the sixteen municipalities considered, have a greater concentration of bed supply through Airbnb compared to the other municipalities of the area. However, this concentration varies between a maximum of 90.6% in Venice (and 90.2% in Rome) and a minimum of 51.7% in Catania. The revenues are also concentrated in the centre, with Taranto being the exception also in this case (43.7%), varying between a maximum of 97.2% in Rome (and 96.6% in Venice) and a minimum of 57.0% in Catania.

The distribution of Airbnb properties throughout Italy also highlights a cluster of cities with a strong tourist attraction (Rome, Venice and Florence) with high rates of occupancy (around 40%) and high average prices (more than 90 Euro) in the capital. There is a further category of cities with occupancy rates of between 30 and 40% (in descending order: Bologna, Verona Trieste, Padua, Bari, Genoa, Milan, Turin and Naples) and very variable average prices (between 80 and 90 Euro in Milan and Verona; around 50 Euro in Turin). Finally, a further cluster of cities in Southern Italy, with the exception of Naples and Bari, shows low rates of occupancy (in descending order: Catania, Palermo, Taranto and Messina) and prices comparable to the lower band of the preceding cluster (from around 59 Euro in Messina to 48 Euro in Taranto).

These findings are consistent with the following economic interpretation: a) high demand saturates the supply and creates pressure on prices; b) there is an oversupply in locations where the market prospects are modest and where the opportunity-cost is lower both of capital (property values are lower, especially in Turin), and of employment (the South/Islands is the area of the country with the highest unemployment rate).

-

8.

Several recent works have attempted to demonstrate that an increase in Airbnb leads to an increase in both rental rates and house prices. Horn and Merante (2017) find that one standard deviation increase in Airbnb density leads to a 0.4% increase in local rents in Boston. Barron et al. (2020) use a dataset of Airbnb listings from various United States cities and find effects of similar magnitude; taken at the sample median, they show that growth in the supply of Airbnb accounts for 0.5% of the increase in annual rents and 0.7% of annual price growth. Garcia-López et al. (2019) show that Airbnb has increased both housing rents and prices in Barcelona: in the areas with higher Airbnb activity, rents increased in about three years by as much as 7%, while increases in transaction prices were as high as 19%.

-

9.

The long-term profitability of an Airbnb property depends on the occupancy rate and average price. Actually, all the occupancy measures reported in this study refer to the rate of occupancy compared to the period of listing. The revenues could also therefore be lower because the property is available on Airbnb for periods shorter than a year: however, there is no evidence of significant disparities in this respect between the big cities (while seasonal tourism might be a significant factor affecting this situation).

-

10.

Obviously, the revenues are not precise indicators of performance. The costs should be subtracted from the income; nevertheless, we have observed that, in the market sector in which Airbnb operates, the marginal costs are fairly modest, whereas the initial investment costs (the building) are, in the majority of cases, sunk costs, therefore not relevant in determining the economic decisions made.

Airbnb and tourist destinations: does it substitute or complement traditional accommodation?

In the previous section, we provided evidence of the “urban appeal” in the supply of Airbnb and the corresponding performance, above all, in the big tourist cities and in some other cities in the Centre-North (in particular, Milan and Bologna). In these cities in particular, over the space of just a few years, with the innovation it has introduced, Airbnb has effectively conquered an equal share of the market as the traditional established hospitality players, and has altered the behaviour on the demand-side.

Among the issues opened following the drastic reconfiguration of the sector, international literature has set out to gain an understanding of the profile of the competition between traditional and innovative hospitality and, especially, to what degree the services offered in the two segments can be considered to substitute or complement each other. The results, whether theoretical or empirical, cannot yet however be considered to be conclusive.

Most contributions in the literature analyse the competition between hotels and Airbnb properties in specific urban areas (for the European situation, see, for example, Gutiérrez et al., 2017 on Barcelona and Quattrone et al., 2016 on London), adopting a micro perspective, in which the object of analysis is the price/location of the individual property and the relative results. Few adopt a broader perspective which enables generalisation, thanks to the observation of the phenomenon in different contexts.

For a higher scale than the urban one, Zervas et al. (2014) analyse the case of Texas and provide evidence of a negative effect on revenues in the hotel industry caused by competition from Airbnb provision. This effect is a statistically significant 0.05% reduction in revenues per 1% increase of Airbnb properties. However, this effect is largely concentrated on the low category hotels, whilst the effect on luxury hotels is statistically negligible. The separation between the segment of demand covered by Airbnb and that served by hotels of a higher category is also supported by Varma et al. (2016), thanks to a series of interviews with managers of some of the principal players in the hotel sector.

Of particular interest is the work of Farronato and Fradkin (2018), who propose a theoretical model of competition in the hospitality market in which the hotels (incumbents) face the threat of entry by price-taker operators, defined as “flexible”, enabled by a P2P platform which allows low entry costs. The predictions of the model are empirically estimated on data from 50 big American cities. The entry of Airbnb entrepreneurs has a significant influence on hotel prices in the sector (more than on the occupancy rate), especially when the demand is more elastic and the hotel supply is capacity-constrained. As the demand for accommodation is usually more flexible the higher the hotel category, the authors, contrary to what is suggested by the above-mentioned contributions, conclude that the entrance of Airbnb generates more consistent effects in the segment of higher category hotels.

Our study can use data about the geographical distribution of the supply of accommodation in both hotels and Airbnb properties, but has only data about the revenues of the latter. We are therefore not able to analyse the competition between the two segments, estimating the cross-effects of quantity and price and to assess the substitutability of the services offered in the two sub-markets. We are however able to analyse the geographical distribution of the Airbnb supply and demand and, in particular, if, and how much, it traces the pattern of demand of “traditional” hospitality, which we believe can be adequately proxied by the supply of hotel services11.

A first picture at national level tells us that the ratio between Airbnb beds and those of hotels and residences is about 1.2, but this ratio varies considerably at local level: it is not uncommon to find LLMAs where the Airbnb supply is consistent and the hotel supply negligible, and vice versa.

-

11.

To approximate the pattern of demand of traditional hospitality with the spatial distribution of the hotel supply seems legitimate, given that the traditional hospitality sector is a mature one, with significant barriers to entry and where we therefore expect the supply to be balanced with the demand. It should also be noted that, as historic data on the presence of hotels is available, we are therefore able to paint a picture of the hotel supply “before” Airbnb’s entry into the Italian market, that is, before any effects of the competition between the two segments were manifested.

If we interpret the LLMA distribution of hotel capacity as a good proxy for the spatial pattern of hospitality demand, we can assume the following power-law function as a benchmark for the cross-sectional presence of Airbnb properties:

Airbnb (hotel) ~ A hotelβ

where β is a scale-invariant elasticity parameter, i.e. the percentage variation of Airbnb supply (Airbnb) as the cross-sectional demand (proxied by hotel) is increased by 1%. A1=A0exp (γ Xj)captures possible characteristics of the LLMA that attract demand (or incentivate offer) and are not included in our demand proxy hotel.

After log-transformation, we propose the following regression model for estimating the impact of hospitality demand on the spatial distribution of Airbnb active properties:

log Airbnb j = α + β log hotel j + γ X j + ε j

where Airbnb j, hotel j and X j, are measured at a LLMA level (j = 1, 2,…., 611) and ε j, is the error term. The vector X includes all the explanatory variables used in the estimation.

References

-

Acquier A, Daudigeos T and Pinkse J (2017) Promises and paradoxes of the sharing economy: An organizing framework. Technological Forecasting and Social Change 125: 1-10.

Adamiak C (2018) Mapping Airbnb supply in European cities. Annals of Tourism Research 71(C): 67-71.

Allegri A and Serpa F (2016) The temporary accomodation phenomenon: housing-tourist in the home hotel. In: Eurau2016 – In Between Scales Conference, Bucharest, Romania, 28-30 September 2016, pp. 1157-1165.

Amin A and Thrift N (2017) Seeing like a city. London: Polity Press.

Artioli F (2018) Digital platforms and cities: a literature review for urban research. Cities are back in town. Working paper 01. Halshs: 01829899.

Balampanidis D, Maloutas T, Papatzani E and Pettas D (2019) Informal urban regeneration as a way out of the crisis? Airbnb in Athens and its effects on space and society. Urban Research & Practice. DOI: 10.1080/17535069.2019.1600009

Barron K, Kung E, and Proserpio D (2020) The effect of home-sharing on house prices and rents: Evidence from Airbnb. SSRN: 3006832.

Belk R (2010) Sharing. Journal of consumer research. 36(5): 715-734.

Belk R (2014) You are what you can access: Sharing and collaborative consumption online. Journal of business research 67(8): 1595-1600.

Benkler Y (2001) Coase’s Penguin, or, Linux and” The Nature of the Firm”. Yale law journal 112(3): 369-446.

Benkler Y (2004) Sharing nicely: On shareable goods and the emergence of sharing as a modality of economic production. Yale law journal 114(2), 273-358.

Botsman R and Rogers R (2011) What’s mine is yours. How collaborating consumption is changing the way we live. London: Collins.

Burtch G, Carnahan S and Greenwood B N (2018) Can you gig it? An empirical examination of the gig economy and entrepreneurial activity. Management Science 64(12)): 5497-5520.

Cocola-Gant A and Gago A (2019) Airbnb, buy-to-let investment and tourism-driven displacement: A case study in Lisbon. Environment and Planning A: Economy and Space. DOI: 10.1177/0308518X19869012.

Codagnone C and Martens B (2016). Scoping the Sharing Economy: Origins, Definitions, Impact and Regulatory Issues. Institute for Prospective Technological Studies Digital Economy. Working Paper 01. SSRN: 2783662.

Crommelin L, Troy L, Martin C and Pettit C (2018) Is Airbnb a sharing economy superstar? Evidence from five global cities. Urban Policy and Research 36(4), 429-444.

Davidson N M and Infranca J (2016) The Sharing Economy as an Urban Phenomenon. Yale Law & Policy Review 34(2): 216-279.

Duranton G and Puga D (2004) Micro-foundations of urban agglomeration economies. In: Henderson J V and Thisse, J-F (eds) Cities and Geography, volume 4 of Handbook of Regional and Urban Economics. Elsevier, pp. 2063 – 2117

Deboosere R, Kerrigan D J, Wachsmuth D and El-Geneidy A (2019) Location, location and professionalization: a multilevel hedonic analysis of Airbnb listing prices and revenue. Regional Studies, Regional Science 6(1), 143-156.

Dematteis G (1999) Introduction. Cities as nodes of urban networks. In: Bonavero P, Dematteis G and Sforzi F (eds), The Italian Urban System. Towards European Integration. Aldershot: Ashgate, pp. 1-16.

Dogru T, Mody M, Suess C, McGinley S and Line N D (2020) The Airbnb paradox: Positive employment effects in the hospitality industry. Tourism Management 77: 104001.

Evans D S (2017) Why the dynamics of competition for online platforms leads to sleepless nights but not sleepy monopolies. SSRN: 3009438.

Farronato C and Fradkin A (2018) The welfare effects of peer entry in the accommodation market: The case of Airbnb. National Bureau of Economic Research. Working paper 24361. DOI: 10.3386/w24361.

Federalberghi (2019) DATATUR Trend e statistiche sull’economia del turismo. October. Rome.

Ferreri M and Sanyal R (2018) Platform economies and urban planning: Airbnb and regulated deregulation in London. Urban Studies 55(15): 3353-3368.

Fields D and Rogers D (2019) Towards a critical housing studies research agenda on platform real estate. Housing, Theory and Society. DOI: 10.1080/14036096.2019.1670724

Frenken K and Schor J (2017) Putting the sharing economy into perspective. Environmental Innovation and Societal Transitions 23:3–10.

Freytag T and Bauder M (2018) Bottom-up touristification and urban transformations in Paris. Tourism Geographies 20(3):443-460.

Friedman G (2014) Workers without employers: shadow corporations and the rise of the gig economy. Review of Keynesian Economics 2(2): 171-188.

Gansky L (2010) The mesh: Why the future of business is sharing. London: Penguin.

Garcia-López M À, Jofre-Monseny J, Martínez Mazza R and Segú M (2019). Do short-term rental platforms affect housing markets? Evidence from Airbnb in Barcelona. Barcelona Institute of Economics. Working Paper 05. SSRN: 3428237.

Gillespie T (2010) The politics of ‘platforms’. New media & society 12(3): 347-364.

Goree K (2016) Battle of the Beds: The Economic Impact of Airbnb on the Hotel Industry in Chicago and San Francisco. Scripps Senior Theses. Paper 776.

Goodwin H (2017) The Challenge of Overtourism” Responsible Tourism Partnership. Working Paper 04.

Grassmuck V R (2012) The Sharing Turn: Why we are generally nice and have a good chance to cooperate ourway out of the mess we have gotten ourselves into. In: Sützl W, Stalder F, Maier R and Hug T (eds). Cultures and Ethics of Sharing / Kulturen und Ethiken des Teilens. Innsbruck: Innsbruck University Press.

Gutiérrez J, García-Palomares J C, Romanillos G and Salas-Olmedo M H (2017) The eruption of Airbnb in tourist cities: Comparing spatial patterns of hotels and peer-to-peer accommodation in Barcelona. Tourism Management 62: 278-291.

Guttentag D (2015) Airbnb: disruptive innovation and the rise of an informal tourism accommodation sector. Current issues in Tourism 18(12): 1192-1217.

Hagiu A (2007) Merchant or two-sided platform?. Review of Network Economics 6(2): 115-133.

Horn K and Merante M (2017) Is home sharing driving up rents? Evidence from Airbnb in Boston. Journal of Housing Economics 38 : 14-24.

Jiao J and Bai S (2019) Cities reshaped by Airbnb: A case study in New York City, Chicago, and Los Angeles. Environment and Planning A: Economy and Space 52(1): 10-13.

Kenney M and Zysman J (2016) The rise of the platform economy. Issues in science and technology 32(3): 61.

Langley P and Leyshon A (2017) Platform capitalism: the intermediation and capitalisation of digital economic circulation. Finance and society. 3(1): 11-31.

MacCannell D (2013) The tourist: A new theory of the leisure class. Berkeley: University of California Press. [First published 1976].

Kenney M and Zysman J (2016) The rise of the platform economy. Issues in science and technology 32(3): 61.

Massey D (2005) For space. London: Sage.

Mhlanga O (2019) Peer-to-peer-travel: is Airbnb a friend or foe to hotels?. International Journal of Culture, Tourism and Hospitality Research 13(4):443-457.

Murillo D, Buckland H and Val E (2017) When the sharing economy becomes neoliberalism on steroids: Unravelling the controversies. Technological Forecasting and Social Change 125: 66-76.

Pasquale F (2016) Two narratives of platform capitalism. Yale L. & Pol’y Rev. 35: 309.

Quattrone G, Proserpio D, Quercia D, Capra L and Musolesi M (2016) Who benefits from the “Sharing” economy of Airbnb?. In: Proceedings of the 25th international conference on world wide web, Montreal: Canada, 11-15 April 2016, pp. 1385-1394.

Rauch D and Schleicher D (2015) Like Uber, but for local governmental policy: the future of local regulation of the ‘sharing economy’. George Mason Law & Economics Research Paper 15-01. SSRN: 2549919.

Richardson L (2015) Performing the sharing economy.”Geoforum 67: 121-129.

Roelofsen M and Minca C (2018) The Superhost. Biopolitics, home and community in the Airbnb dream-world of global hospitality. Geoforum 91: 170-181.

Rogers D (2016) Uploading real estate: Home as a digital, global commodity. In: Cook N, Davison A and Crabtree L (eds). Housing and Home Unbound: Intersections in economics, environment and politics in Australia. London: Routledge, pp. 37-52.

Schor J (2016) Debating the sharing economy. Journal of Self-Governance and Management Economics 4(3): 7-22.

Schor J and Attwood‐Charles W (2017) The “sharing” economy: labor, inequality, and social connection on for‐profit platforms. Sociology Compass 11(8): e12493.

Semi G and Tonetta M (2020) Marginal hosts: Short-term rental suppliers in Turin, Italy. Environment and Planning A: Economy and Space. DOI: 10.1177/0308518X20912435

Slee T (2017) What’s yours is mine: Against the sharing economy. New York: Or Books.

Srnicek N (2016) Platform capitalism. Cambridge (UK): Polity Press.

Sundararajan A (2016) The sharing economy: The end of employment and the rise of crowd-based capitalism. Cambreidge (USA): Mit Press.

Varma A, Jukic N, Pestek A, Shultz C J and Nestorov S (2016) Airbnb: Exciting innovation or passing fad? Tourism Management Perspectives, 20: 228-237.

Wachsmuth D and Weisler A (2018) Airbnb and the rent gap: Gentrification through the sharing economy. Environment and Planning A: Economy and Space 50(6): 1147-1170.

Zervas G, Proserpio D and Byers J (2015) A first look at online reputation on Airbnb, where every stay is above average. SSRN: 2554500.

Zervas G, Proserpio D and Byers J (2017) The rise of the sharing economy: Estimating the impact of Airbnb on the hotel industry. Journal of Marketing Research 54(5): 687-705.

© Chiara Iacovone, Francesco Milone.

Users may download and/or print one copy to facilitate their private study or for non-commercial research. Users may not engage in further distribution of this material or use it for any profit-making activities or any other form of commercial gain.